Mining accidents can and do happen. And when they do, clear and transparent communication from management can help calm fears, reassure investors, and stabilize the stock.

Late Monday, June 24, Victoria Gold halted the stock and then put out a brief news release later that day stating that the heap leach pad at the mine experienced failure and that a “portion of the failure had left containment.”

It was a brief press release by any objective measure. Any experienced reporter would tell you that it raises more questions than it answers.

When the stock resumed trading the next morning, Victoria’s stock immediately dropped 83 percent, wiping off $411 million of the company’s market value.

For the rest of the week of June 24 – 28, there was no other news from the company and the stock lost ground every single day of that week.

During that week, I watched with fascination as one media organization after another shaped, dissected, and defined the disaster in detail. Here’s a sampling of the headlines and the facts as reported:

The Globe and Mail:

- First Nations concerned; Victoria Gold, Yukon government playing down impact of Eagle mine cyanide spill.

- Victoria Gold CEO’s cell phone number “no longer in service.”

The Financial Post:

“…contaminated water that overflowed in a landslide and equipment failure is being pumped into storage ponds, while the investigation continues…”

The Northern Miner:

- Victoria Gold must rapidly secure landslide site: expert.

- Victoria Gold charged after second landslide at Eagle mine this year.

- Photos of Victoria Gold accident show heap leach landslide in Yukon.

Stockwatch:

- Globe says Victoria Gold’s CEO goes walkabout.

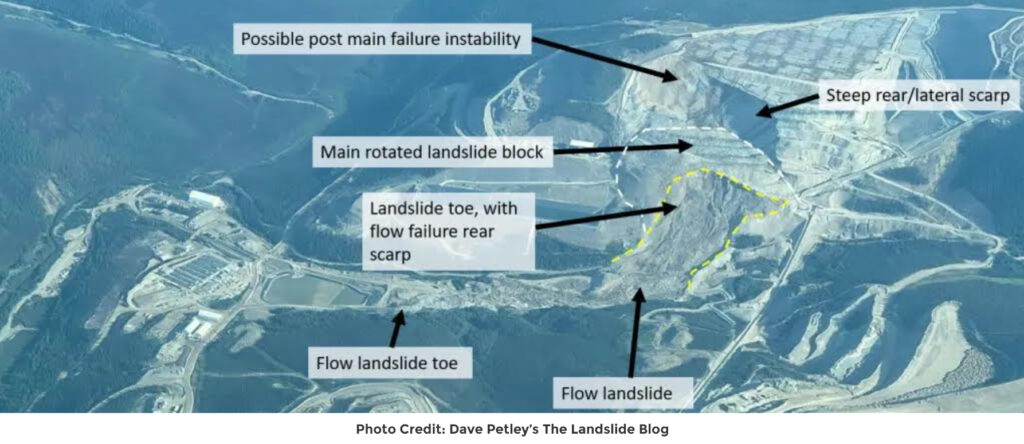

Dave Petley’s The Landslide Blog

- “I would also be concerned about the potential for a further flow type failure from the main rotated block. Whilst failure could occur at any time, the main risk may be during heavy rainfall. Urgent, large-scale works are likely to be needed to reduce the risk of failure. The costs are going to be substantial as the volumes of material are massive.”

HAS VICTORIA GOLD LOST CONTROL OF THE NARRATIVE?

As I gleaned additional information about the accident from outside sources — contaminated water being pumped into a storage pond, Dave Petley’s photographic dissection of the extent of the slide, the concerns of the First Nation Na-Cho Nyak Dun about threats to their water, fish and wildlife, the need to secure the site before to prevent further slide and before the arrival of rain, the fact that workers were sent home for 120 days — I was left wondering why management has not been more proactive at communicating these to the public.

In a nutshell, the company has lost control of the narrative concerning the accident to outside organizations. Instead of the company telling its story – and its plan to mitigate the disaster – in a coherent manner, the story is being shaped haphazardly as the news hungry media grasps at any rumour.

There are many critical issues stakeholders need to know, including but not limited to, an estimate of the mine infrastructure damaged by the slide, projected clean-up costs; how much of the inventory will need to be written down; how much of the cyanide- laden water has escaped the site, if any; what is being done to contain and rehabilitate the damage, and the costs of such endeavours, etc.

In the absence of a follow-up press release, stakeholders are left speculating — and fearing the worst. No wonder, the stock kept sliding the rest of the first week.

Coming into the Canada Day long weekend, I was thinking management would have a chance to rest and put out a follow-up press release. After all, there must have been a lot of actions taken at the site that fateful week and that after one week, management would have a better idea what actions are needed.

When the market opened again after the long weekend, I was astounded to find there was no additional news from the company. Not surprisingly, the stock dropped another 20 percent, closing that day at $0.84, giving the company a market value of $57 million.

And what a destruction of shareholder value it was, considering that the stock was peaking at around nineteen dollars as recently as the first quarter of 2022.

WHAT CAN WE LEARN FROM THE DEBACLE?

Before starting a career in M&A and corporate finance in the mineral exploration industry, I had explored opportunities in public relations. I knew right away the leach pad failure is a classic crisis management event.

In this age of increasing transparency, if not handled properly, the crisis has the potential to worsen the situation than it already is. This is because in the absence of facts from the company, rumours will prevail.

In the best-case scenario, they will erode trust among employees, shareholders, and First Nations on whose land the company operates. The effect on shareholders will not be pleasant either: unnecessary fears as they are grappling in the dark about what’s happening.

Does Victoria Gold deserve a tiny market value of $57 million? I don’t know. But I do know that there are numerous questions swirling around the event and the necessary clean-up process. The sooner the information is provided in a clear and transparent manner, the sooner shareholders will be assured and the market will be in a position to assess the value of the company.

Until then, the human tendency is to fear for the worst.

THE LESSONS

#1. Return every reporter’s call — fast. Make the CEO or a designated person available to answer questions. Have a list of talking points and stick to them. The optics of the CEO’s mobile phone being disconnected during the crisis is simply terrible. Reporters will write what they want to write anyway. So it’s best to keep them on your side by giving them the facts — and your perspective.

#2. Have a designated spokesperson. Who’s speaking for Victoria Gold? It’s not clear to me who that person is right now. Why is the media quoting the Government of Yukon all the time? This could create the perception among First Nations that the government is biased and downplaying the damage.

#3. Provide facts and an action plan to address the crisis. Why do investors have to learn that contaminated water is being pumped to a storage pond from second-hand sources? Why doesn’t the company provide a picture of the damage?

#4. Be transparent. The extent of the damage will be known quickly anyway. All that information will be posted. So why not beat the outside source to the punch? Investors, shareholders, employees, First Nations, and the government want to know what the clean-up costs may be and the length of time needed. All this information needs to be provided quickly. If uncertain about the actual amount, a disclaimer can also be included.

#5. Once the crisis subsides, have a plan in place to make sure such an accident will never happen again. Communicate it clearly to the public.

(Hai is the author of Into the Unknown, an international thriller about a geologist taken hostage by Islamic fundamentalists in Mali.)